Capital structure Textile firms Stock exchange and Pakistan. First it extends the range of theoretical determinants of capital structure by examining some recently developed theories that have not as yet been analyzed empirically.

Heterochromatin And Euchromatin Transcription Tutorial Pie Chart

First it examines a much broader set of capital structure theories many of.

. The significant determinants of optimum capital structure are risk cost of capital flexibility conservatism sales and growth inflation and cash flow. Up to 10 cash back The composition of debt and equity in the capital structure of business undertakings is a financial decision that determines their fortune as it has significant influence in determining the discounting factor for capital budgeting decisions and market value of firms Durand 1952. Choi2014 investigated the important determinants of capital structure of the 50.

Determinants of Capital Structure An Empirical Evidence US By Ra The University of Lahore Pakistan. The determinants of this study like liquidity of firms non debt tax shields like depreciation more collateral net fixed assets earnings volatility size of firms net commercial trade position and firms profits have impact on the capital structure choice. Size profitability growth asset tangibility.

Optimum capital structure may be defined by Parmasivan Subramanian 2009 as the capital structure or combination of debt and equity that leads to the maximum value of the firm. The taxonomical structure provided the basis for such investigation. The article by Rezaei 2018 investigated the determinants of capital structure of MCs and DCs listed in Tehran stock exchange.

Because there is positive relationship between increasing of profitability and. Furthermore empirical findings should help corporate managers to make optimal capital structure decisions To the authors knowledge this is the first study that explores the determinants of capital structure of manufacturing firms in. Based on the data availability the following theoretical attributes of capital structure were analyzed in this study like size profitability tangibility non-debt tax shields as defined by.

Capital Structure The question of capital structure has received a lot of attention from economists for quite sometime. Determine the capital structure choi ces of firm s. If company has power to control its expenses and earn more from its sale then company can use more debt resources in the capital structure.

The choice of a proper mix of debt and equity depends on the various factors like nature of the product earnings stage of growth of the company and management attitude towards control etc. Debt and equity will be decided on the basis of profitability. Second since some of these theories have different empirical implications with regard to different types of debt instruments we analyze separate measures of short-term.

Abstract- This paper develops a study on identifying the most significant determinants of capital structure of 15 firms listed on the SP 500 index New York Stock Exchange using panel data over 5 years period from 2010 to 2014. In capital structure determinants inflation and cash flow we explained that businesses with large or increasing cash flows. In addition Multinational Companies were significantly larger than DCs and were provided with more.

The capital structure decision is the second most crucial decision that a finance manager has to take. One factor that can play a role in this is the level of sales. Discussion of the results and.

Overall our results support previous findings suggesting that financial deficit free cash flow the z-score and deviation from leverage are among the main determinants of capital structure complexity. He showed that profitability growth rate firm age firm size and tangibility are the main determinants of capital structure of sample firms. The study extends empirical work on capital structure theory in three ways.

Chandrasekharan 2012 analyzed the determinants of capital structure in the Nigerian firms for the period 2007 to 2011. We investigate the determinants of capital structure of public listed companies on Bursa Malaysia Singapore Stock Exchange and Thailand Stock Exchange from 2004 to 2013. Optimum capital structure is the capital structure at which the Weighted Average Cost of Capital WACC is minimums and thereby the value of the firm is maximums.

Its meaning is to reach a point where the two primary forms of. Determinants of Capital Structure. Abstract 1 Research Problem.

Firms leverage was found to be associated with industry class size. Optimum Capital Structure is required for the smooth running of an enterprise. To re-examine the issue of non-linearity in capital structure choices of firms through the application of the hitherto un-applied technique of panel data unconditional quantile regression with a view to indirectly ascertain the applicability of Trade-off Theory Agency Cost theory and Pecking Order Theory through the analysis of the.

Understanding Optimum Capital Structure. Introduction These Slides concepts are According to the Article 5. Modigliani and Miller 1963Thus capital structure.

Non-debt tax shields and dividend as possible determinants of the capital structure choice. China capital market. EVIDENCE FROM CHINA Samuel GH Huang And frank M.

This paper documents the determinants of capital structure in Chinese-listed companies and investigates whether firms in the largest developing and transition economy of the world entertain any unique features. Results showed that compared to Domestic Companies Multinational Companies have a significantly lower leverage. The focus of this study is to discuss these factors influencing the capital structure of quoted companies.

Stable sales would indicate flattening revenue and therefore cash flow. This is imperative as the corporate sector in Nigeria is characterized by a large number of firms operating in a largely deregulated and. Profitability is the second determinants of capital structure.

Determinants of Capital Structure. Whether sales are growing or stable also determines capital structure choice. Are reliably important firm characteristics that.

Ferri Wisley 1979 investigated the relationships between a firms financial structure and its industrial class size variability of income and operative leverage. DETERMINANTS OF CAPITAL STRUCTURE. Specifically we try to answer the following two questions.

We also investigate how firm-specific factors such as profitability firm size tangibility of assets and depreciation to total assets along with the macroeconomic factor such. The Determinants of Capital Structure Choice SHERIDAN TITMAN and ROBERTO WESSELS ABSTRACT This paper analyzes the explanatory power of some of the recent theories of optimal capital structure.

Conceptualization Of Social Capital Simplifying The Complexity Of The Download Scientific Diagram Social Capital Simplify Social

Predicting Long Term Debt In The Healthcare Sector Paperback Walmart Com In 2022 Business Risk Health Care Debt

Modern Economic Growth Findings And Reflections Kuznets S 1973 In American Economic Review Vol 63 No 3 Pp 247 258 Growth Reflection Modern

A History Of U S Bull And Bear Markets Bear Market Investing Stock Market

Population Geography Geography Coaching Institute In Delhi Map

Holiday Shopping Budget Templates 7 Free Doc Xlsx Pdf Budget Template Free Budget Template Budgeting

An Analysis Of The K R G Oil Sector According To The Five Forces Framework Analysis Framework Economies Of Scale

Pin By Neil Patrick On Kiosk Education How To Memorize Things Marketing Jobs

Conceptual Framework Nursing Conceptual Framework Conceptual Nursing Theory

What Is Income Elasticity Of Demand Types Formula Example Income Business And Economics Managerial Economics

Title Theme Tloz The Wind Waker Violin Music Wind Waker The Wind Waker

What Is Law Of Supply Exceptions Assumptions Example What Is Law Economics Lessons Law Of Demand

Capital Structure Determinants Paperback Walmart Com In 2021 Bombay Stock Exchange Stock Exchange Capital Market

Role Of The Financial System Financial Make Business Business Studies

Autonomous Expenditures And How Does They Affect The Economy Basic Concepts Business Investment Macroeconomics

Tesla Motors Case Study Business Analyst Michael Porter Business Analysis

Sale Of Bonds Or Stock To The General Public Mgt232 Lecture In Hindi Urdu 27 Youtube In 2021 Business Finance Capital Market Stock Market

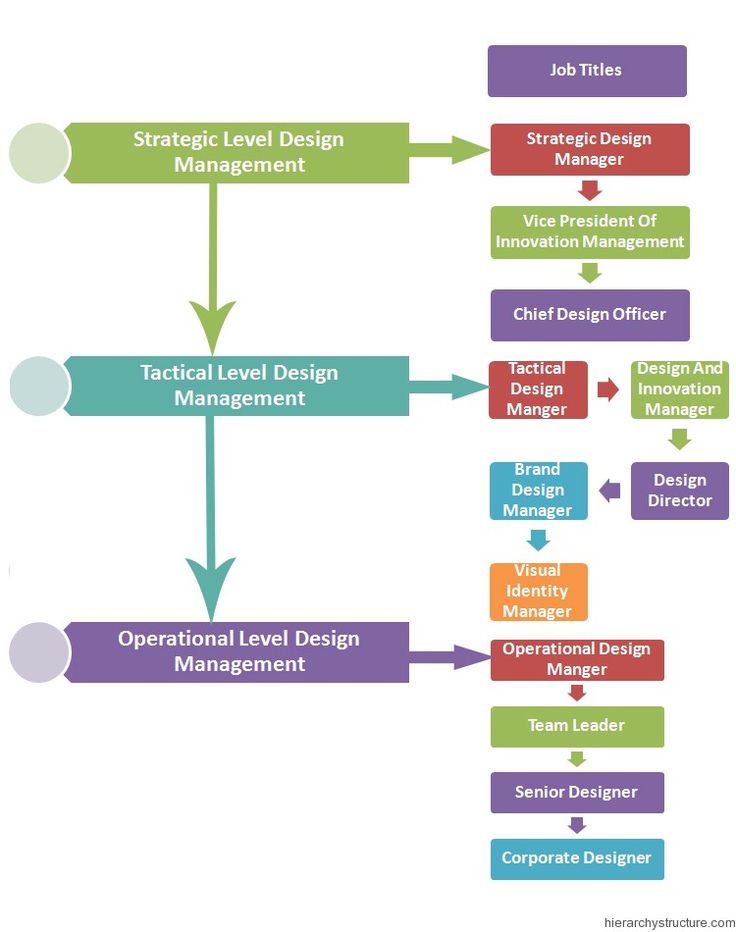

Design Management Hierarchy Design Management Innovation Management Branding Design